Admin I Monday, February 09.26

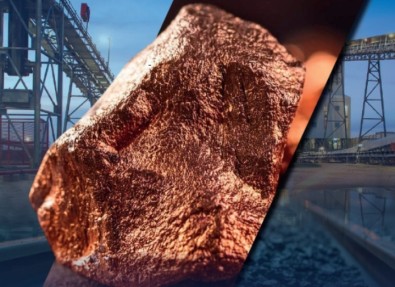

CAPE TOWN — Africa is sitting on an estimated $29.5 trillion in mine-site mineral value, yet the continent remains a “marginal supplier” of raw materials, failing to capture the vast economic upside of its own resources.

A landmark study released today by the Africa Finance Corporation (AFC) at the Mining Indaba conference warns that without a fundamental “rewiring” of the sector around domestic industry and infrastructure, the continent will remain at the mercy of volatile Asian demand cycles.

The report, titled Compendium of Africa’s Strategic Minerals, reveals a stark disconnect between endowment and execution.

While Africa holds 20% of global mineral wealth, roughly $8.6 trillion remains entirely undeveloped.

The AFC attributes this stagnation to fragmented geological data and a high-risk perception that deters exploration capital.

However, the study argues that even the $29.5 trillion figure is a conservative estimate.

When measured at the point of industrial use—after being processed into steel, aluminum, batteries, or fertilizers—the value of Africa’s endowment expands by an order of magnitude.

”Today, AFC is proud to launch an initiative to reframe the sector through an African lens,” said Samaila Zubairu, President & CEO of AFC.

“The Compendium maps full value chains and links reserves to processing capacity, power, and transport infrastructure.”

Vulnerability to Global Shocks

The danger of the current “extract and export” model is currently being felt across the continent. African supply chains remain “commercially tethered” to Asian industrial cycles, particularly China’s property market.

The report highlights several recent casualties of this dependency:

Democratic Republic of the Congo: Cobalt production quotas were imposed to combat price collapses.

Gabon: Manganese operations have faced periodic suspensions due to soft alloy demand.

South Africa: Primary steelmaking capacity has shuttered despite a domestic need for materials to build housing and power systems.

Infrastructure as the Missing Link

The AFC posits that infrastructure is not merely a “passive enabler” but the very system required to make beneficiation (local processing) viable.

The report calls for a strategic focus on shared rail corridors and cross-border power transmission.

By aligning mineral deposits with clean energy hubs and logistics corridors—such as the Lobito Corridor—African nations can reduce the carbon intensity of their exports, making them more attractive in a global economy increasingly focused on green industrialization and traceable supply chains.

A New Geo-Economic Strategy

As global powers seek to de-risk their supply chains and reduce concentration in certain markets, Africa has a “strategic window” to position itself as a reliable alternative for critical minerals like rare earths, graphite,

and lithium.

There are signs of momentum.

Rare earth projects in Angola, graphite anchors in Mozambique, and the resumption of uranium production in Namibia and Malawi suggest that the continent is beginning to move up the value chain.

The AFC’s message to investors and policymakers is clear: the path to African prosperity lies not in digging more holes, but in building the industrial corridors that connect those holes to the continent’s future.