By Emmanuel Thomas l Tuesday, October 07, 2025

CAPE TOWN — Uganda’s flagship oil refinery project, designed to process 60,000 barrels per day (b/d), is scheduled to commence operations between the fourth quarter of 2029 and the first quarter of 2030.

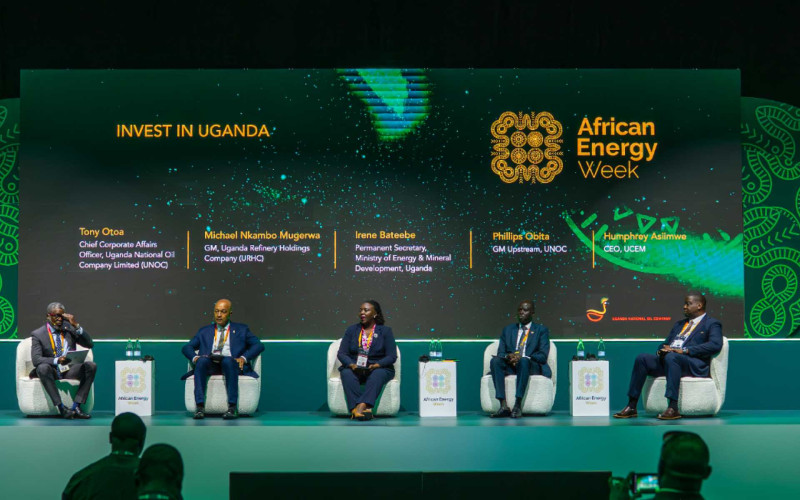

The timeline confirmation came from Michael Nkambo Mugerwa, General Manager of the Uganda Refinery Holding Company, at the African Energy Week (AEW) conference in Cape Town last week.

The $4 billion facility, slated for construction in Kabaale, Hoima District, is a joint venture following a March 2025 agreement between the Uganda National Oil Company (UNOC) and UAE-based Alpha MBM Investments. The funding structure mandates UNOC to contribute 40% of the capital, with Alpha MBM covering the remaining 60%.

Mugerwa emphasised that the project extends beyond fuel, aiming to capture the full value chain encompassing petrochemicals, kerosene, fertilisers, and gas processing.

Industrial Park Catalyses $6 Billion Investment

Alongside the refinery, a supporting industrial park is under development, attracting a committed investment of between $3 billion and $4 billion, with the potential to draw an additional $1 billion to $2 billion.

According to Mugerwa, this industrial ecosystem is already showing traction, with approximately 15 investors having committed to the park.

To support this major infrastructure drive, progress is being made on roads, water facilities, and a robust high-voltage power supply of 200 MW. The finished complex is expected to provide products for regional markets, including Tanzania and the Democratic Republic of the Congo (DRC).

$5 Billion Committed to Power Infrastructure

The refinery forms part of a broader national push for infrastructure-led economic growth.

Irene Bateebe, Permanent Secretary in the Ministry of Energy and Mineral Development, highlighted a commitment of $5 billion toward power infrastructure. This investment aims to expand the nation’s diversified energy portfolio to 10,000 MW, incorporating hydro, solar, and nuclear power sources.

Separately, UNOC’s upstream General Manager, Philips Obita, noted the national oil company holds commercial interests of up to 150,000 barrels and is a participant in the East African Crude Oil Pipeline (EACOP) project.

The company is also advancing five exploration projects, with geophysical seismic studies scheduled for completion in November 2025.

The competitive environment for investors was stressed by Humphrey Asiimwe, CEO of the Uganda Chamber of Energy and Minerals, who pointed to the nation’s zero-per cent import tax on equipment for foreign investors, providing a strategic springboard to markets in Tanzania, Kenya, and the DRC.