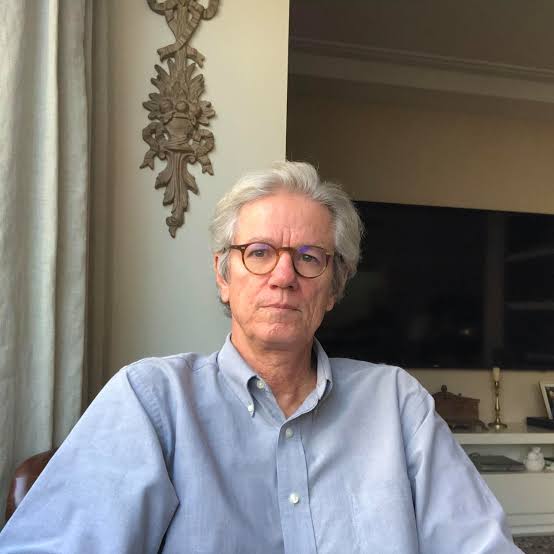

- Paulo Nogueira Batista Jr., a former Executive Director at the IMF

By SCM REPORTER I Thursday, Jan.26

THE ALMIGHTY dollar is under “suicidal” attack—and the call is coming from inside the house.

A former big-hitter at the International Monetary Fund (IMF) has delivered a stinging reality check, claiming the United States is single-handedly trashing its own currency.

Paulo Nogueira Batista Jr., a former Executive Director at the IMF, told RT that the US has become its own “main enemy,” sparking a global panic that has sent rival nations sprinting for the exit.

The $300 Billion Blunder

According to the money expert, the “turning point” came in 2022 when the West froze a staggering $300 billion (£235bn) in Russian reserves following the invasion of Ukraine.

While the move was intended to cripple Putin’s war machine, Batista warns it backfired by terrifying every other country with a “rainy day fund” kept in US banks.

”When you weaponize your currency, you lose the world’s trust,” one insider noted. “Now, everyone is looking at their bank balance and wondering if Uncle Sam will flip the switch on them next.”

The New Gold Rush

The fallout has triggered a massive shift in the global power balance. Heavyweights like China and Russia are reportedly dumping US Treasuries—essentially loans to the American government—at a record pace.

Instead of paper money, they are piling into Gold. By hoarding bullion, these nations are building a “sanction-proof” fortress, making it harder for Washington to dictate terms through financial pressure.

For decades, the US Dollar has been the undisputed king of the world. It’s the “reserve currency,” meaning almost everything from oil to iPhones is traded in greenbacks.

This gives the US immense power to borrow money cheaply and slap sanctions on its enemies. However, if countries stop using the dollar, that power evaporates.

Critics warn that if the “de-dollarization” trend continues:

Prices could soar as the dollar loses its value.

US influence on the world stage would be permanently weakened.

Interest rates could stay higher for longer.

For now, the dollar remains the biggest player on the pitch—but with the IMF’s former top brass warning of a “self-inflicted” wound, the crown is looking heavier than ever.