By SCM Reporter

China has pulled the plug on all new investment in Israel, designating the country a “high-risk area” as geopolitical tensions over the Gaza conflict reach a breaking point.

The shock directive from Beijing effectively freezes one of the Middle East’s most significant financial pipelines.

According to reports from Ynet, Chinese state authorities have blacklisted Israel for new ventures, citing the ongoing volatility and security concerns following the outbreak of the war in Gaza.

The move isn’t just diplomatic posturing—it’s already hitting the ground.

At least one major Chinese investment fund has reportedly used the new “high-risk” designation to tear up an existing deal with an Israeli firm, refusing to honor a previously agreed-upon contract.

Insiders suggest this is a massive blow to Israel’s tech and infrastructure sectors, which have historically relied on Chinese capital for rapid expansion.

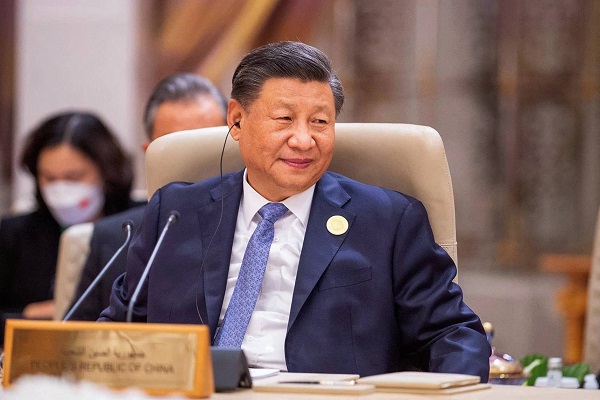

While China has long maintained a “business first” approach in the region, the scale of the Gaza conflict appears to have shifted the calculus in Beijing.

Diplomatic Shift: Historically, China and Israel enjoyed a booming economic partnership, particularly in port management and high-tech R&D.

The Gaza Factor: Since the conflict began, Beijing has become increasingly critical of Israeli military actions, aligning itself more closely with Global South narratives and calling for an immediate ceasefire.

Risk Management: By labeling Israel “high-risk,” Beijing provides a legal “out” for its state-backed firms to withdraw without the usual financial penalties associated with breach of contract.

This isn’t just about a few canceled contracts. China’s “Great Wall” against investment marks a significant pivot in global alliances. If other major Asian economies follow suit, Israel could find itself increasingly reliant on Western markets at a time when global inflation and interest rates are already squeezing the economy.

For now, the message from the East is loud and clear: the money has dried up.