Verve…Leading the way with exciting payment innovation for Nigeria

Admin l Friday, 27 January 2023

LAGOS, Nigeria – Africa’s payment landscape has developed in leaps and bounds over the last decade, with outstanding growth in the cards and tokens segment.

This growth has been driven by several factors, a few however stand out. The increasing knowledge around digital payments, growing mobile and internet penetration and the doggedness of the players within the payment space who have been insistent on making digital payments work in Nigeria.

Verve, as the first indigenous card brand out of Nigeria has contributed in no small measure to the success the landscape has enjoyed and the ease of payment that is now considered normal. Emerging at a time when all the odds were stacked against it, the Verve scheme has stood its ground for over a decade, discounting the informed projections of the experts who predicted that competing against international giants like Mastercard and Visa for market share would be impossible.

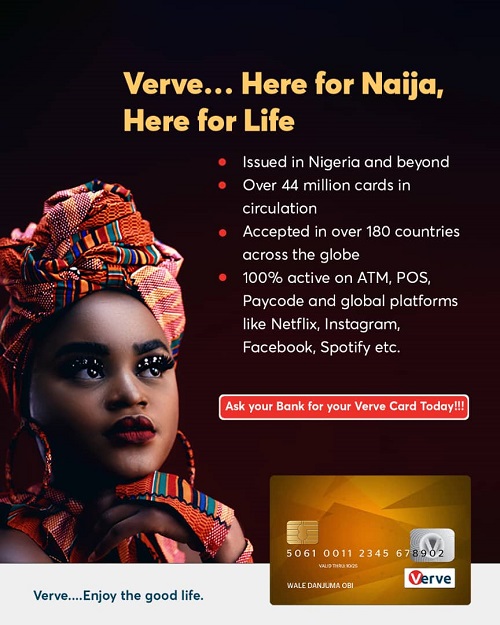

Propelled by the need to deliver homegrown payment solutions that are less expensive, just as effective, and more suited to the average Nigerian, the Verve card has continued to expand its reach, portfolio, and offerings. Today, Verve is accepted and issued across Nigeria, active in several African countries and functional in over I80 countries of the world.

Leveraging strategic partnerships, Verve has consistently offered the everyday Nigerian the access to do more. With over 44 million cards in circulation, and 50 million active tokens, there is no debating the fact that Verve is indeed Africa’s preferred payment card.

As a proudly Naija and African card scheme leading the way with innovative, affordable, and reliable payment services, Verve is already pushing the frontiers of the future, exploring emerging technologies like digital currencies and contactless payments.

In keeping with the brand’s promise to connect Africa to global exchange, Verve is currently collaborating with the Central Bank of Nigeria on Nigeria’s digital currency – eNaira. Verve has also continued to drive seamless governance by powering citizen identification across multiple states with a special brand of customised identity cards, leveraging a strong community of over 250 scheme members spread across Banks and Other Financial Institutions (OFI). The most issued card in Nigeria, Verve is accessible in multiple expressions, Debit, Credit, Prepaid, Virtual.

Building on its massive investment of talent, innovation, and commitment; it is evident that Verve will be powering payments across Nigeria and Africa at large for decades to come. This was confirmed by the Managing Director, Verve International, Mr Vincent Ogbunude, who affirmed that Verve is already innovating for the future and putting technology in place to connect Africans to the future of payments. Verve card users are further encouraged to look forward to exciting new possibilities in the Transport and Health sectors, powered by Africa’s most successful indigenous card scheme.

While other competing card brands may continue to emerge along the line, Verve remains the tested and proven card scheme that will continue to prioritise the interest of the everyday card user in Nigeria, and Africa. Rest assured that the Verve card is, and will remain active, across all touchpoints, including ATMs, POS, online both locally and globally on platforms like Netflix, Flywire, Spotify, and Instagram, among others.

To further assure users of its commitment to Nigeria, Verve recently rewarded its users with prizes worth over 70 million Naira in the recently concluded Verve Good Life promo where over 20 millionaires emerged. Verve card holders across the country can relax as they continue to enjoy the good life on the Verve network.